In today’s business landscape, sustainable supply chain management (SSCM) is no longer simply an aspiration but is now becoming a necessity. SSCM integrates environmentally sustainable practices throughout the supply chain, ensuring that each step, from raw material sourcing to product delivery, aligns with sustainability goals.

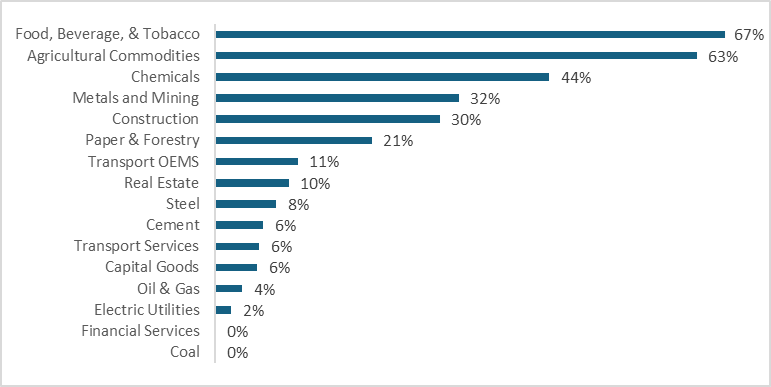

Emissions generated from suppliers, known as “Purchased Goods and Services” as defined by the GHG Protocol, is one of 15 different categories of Scope 3 emissions but accounts for a significant portion of those Scope 3 emissions across industries. Manufacturing-oriented sectors on average have a higher percentage of Scope 3 emissions from supplier purchases.

Supplier Emissions as a Percentage of Total Scope 3 Emissions by Sector

The proliferation of reporting frameworks and disclosures requiring Scope 3 emissions indicates this requirement is here to stay. Companies doing business in Europe are required to confirm to Corporate Sustainability Reporting Directive (CSRD) standards, and the UK and Canada are expected to include similar Scope 3 reporting requirements.

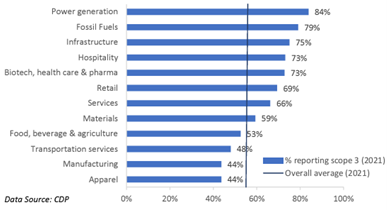

The percentage of US companies reporting Scope 3 emissions has increased from 50% to 56% between 2010 and 2021, according to CDP, and is expected to increase as additional countries require GHG emissions reporting. Currently, the percentage of companies reporting Scope 3 emissions varies by sector with manufacturing-oriented industries on the lower end (44-53%).

Scope 3 Emissions Reporting Percentage by Sector

Beyond regulatory compliance, the importance of SSCM has never been more relevant. Within the current business landscape, investors, consumers, and other stakeholders are calling for more transparency and SSCM initiatives. However, to meet these demands, companies are facing significant pain points, including the complexity of tracking Scope 3 emissions, ensuring supplier compliance, and the initial high costs of sustainable technologies. To justify investment and resources needed to address these stakeholder demands and existing pain points, the financial benefits of sustainable practices must be identified clearly to secure senior management and internal support.

Opening Pandora’s Box

A robust GHG emissions inventory expands supply chain visibility, enabling insight into supplier performance. Emissions data reflects production intensity and therefore serves as a proxy measure for resource and energy efficiency within the value chain. A willingness to peer into “Pandora’s Box” enables companies to see what is occurring within their supply chains and establishes a baseline of performance. Certain approaches will optimize gathering relevant and accurate data. These approaches include:

- Supplier engagement: Direct communication, surveys, workshops, and inclusion of emissions data requirements to procurement contracts

- Data management: Centralize data platforms and tools to collect, store, and manage data from various stages of the value chain

- Leverage existing business processes: Develop a phased approach to integrate reporting requirements into core business strategies

- Build internal capacity: Develop expertise through hiring, training, or using external resources

Moving the Needle

Once a baseline of emissions data is established, companies can pivot their focus to reducing emissions through abatement strategies, which also drives cost savings, increased reliability, and waste reduction. These initiatives should be based on proven strategies including consideration for key factors that significantly influence the outcomes of these initiatives. In addition to integration with materiality assessments and target setting, abatement strategies should also include:

- Circular economy practices: Including recycling, reusing, and reducing waste

- Renewable energy integration: Encouraging or requiring suppliers to use renewable energy sources

- Predictive modeling: Conduct scenario analysis to understand future emissions based on different business and policy scenarios

- Product design and prototyping: Incorporating design to value principles

- Industry collaboration: Participate in industry-wide initiatives, working groups, and sector guidance to develop common methodologies, best practices, and collective knowledge

Measuring Financial Benefits

To secure senior management and internal support, companies must make a strong business case for SSCM. The following categories of financial benefits are associated with implementing sustainable supply chain management:

- Cost savings from resource and energy efficiencies and waste reduction

- Reduced procurement costs

- Enhanced brand reputation and price premium

- Risk mitigation

- Favorable financing terms and increased investment

- Competitive advantage from innovation

Companies should view sustainable supply chain management as a long-term investment not only in their brand reputation, customer loyalty, and regulatory compliance, but also as a source of financial benefits that complements environmental benefits. Managing the challenges and costs of SSCM may seem overwhelming at first, which is why incremental steps through small initiatives such as pilot projects are advantageous. Exploring more about SSCM and supporting services enables companies to navigate the complexities of making their supply chains sustainable.

For more insights and guidance on implementing SSCM initiatives, contact Canopy Edge today to start your journey on transforming your supply chain to secure a more sustainable future.