A carbon tax is levied on the carbon content of fossil fuels. The term can also refer to taxing other types of greenhouse gas (GHG) emissions, such as methane. A carbon tax puts a price on those emissions to encourage consumers, businesses, and governments to produce less of them. A carbon tax differs from a cap-and-trade program in that it provides a higher level of certainty about cost, but not about the level of emissions reduction to be achieved (cap and trade does the inverse).

The cap on GHG emissions that drive climate change is a firm limit on pollution. The cap gets stricter over time. The trade part is a market for companies to buy and sell allowances that let them emit only a certain amount, as supply and demand set the price. Trading gives companies a strong incentive to save money by cutting emissions in the most cost-effective ways.

Carbon credits are permits that allow the owner to emit a certain amount of carbon dioxide or other GHGs. One credit allows the emission of one ton of CO2 or the equivalent of other GHGs. Carbon credits are also known as carbon allowances. Organizations can also purchase carbon offsets, which allow them to have a “net-zero carbon emission” rate. Carbon offsets fund emissions-reduction activities such as tree planting or nature conservation in lieu of completely eliminating their own emissions. More than 190 nations signed the Paris Agreement of 2015, which set emissions standards and allowed for emissions trading.

Taxes on GHGs come in two broad forms: an emissions tax, based on the quantity an entity produces; and a tax on goods or services that are generally GHG-intensive, such as a carbon tax on gasoline.

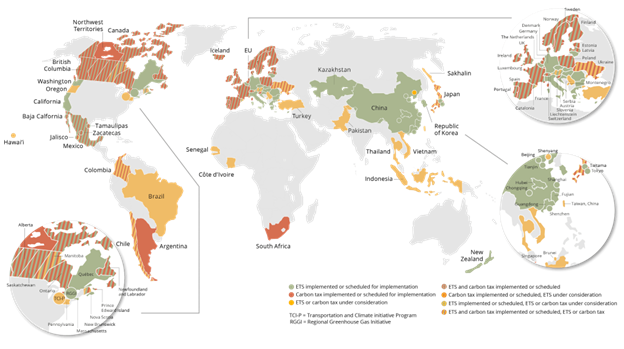

Global Carbon Pricing Map

A number of countries, regions, and local governments around the world have a Pigouvian carbon tax or something similar to an energy tax related to carbon content. As of 2024, 37 carbon tax programs in 27 countries such as Argentina, Canada, Chile, China, Colombia, Denmark, the European Union (27 countries), Japan, Kazakhstan, Mexico, New Zealand, Norway, Singapore, South Africa, South Korea, Sweden, the United Kingdom, and Ukraine have been implemented around the world. British Columbia has had a carbon tax since 2008. The carbon tax is an important part of the Province’s CleanBC plan. The current carbon tax rate is $65 per ton of carbon dioxide equivalent (CO2e) and is applied to the purchase and use of most fossil fuels in the province. South Africa became the first African country to implement a carbon tax in 2019. In 2006, the city of Boulder, Colorado became the first US city with a directly voter-approved carbon tax, and other cities are exploring the idea, the fee for which currently works out to a cost of about $5 per ton for emitters, far less than the roughly $51 per ton social cost of carbon that is accepted widely.

There are several opportunities and benefits tied to the carbon tax approach.

Revenue: A carbon tax can raise significant revenue. How that revenue is used is ultimately a political choice. Some or all of it could be returned to consumers in the form of a dividend. Alternatively, it could be reinvested in climate-related projects, such as advancing low-carbon technologies or building resilience.

Point of Taxation: A carbon tax can be levied at any point in the energy supply chain. The simplest approach, administratively, is to levy the tax “upstream,” where the fewest entities would be subject to it (for instance, suppliers of coal, natural gas processing facilities, and oil refineries). Alternatively, the tax could be levied “midstream” (electric utilities) or downstream (energy-using industries, households, or vehicles).

California’s $19 billion carbon market is one of the most significant and influential in the US. California also has a joint carbon market with Quebec, which helps to increase the market’s size and stability. The way one can comply with these programs is buy offsets, reduce emissions or obtain allowances. The EU carbon market or Emission Trading System is world’s first and largest well thriving while the US has immense potential to take off in this area in future.

The Regional Greenhouse Gas Initiative (RGGI) is the first mandatory cap-and-trade program in the United States to limit CO2 emissions from the power sector. Eleven states currently participate in RGGI: Connecticut, Delaware, Maine, Maryland, Massachusetts, New Hampshire, New Jersey, New York, Rhode Island, Vermont, and Virginia.

Existing tax credits under the Inflation Reduction Act include doubling of R&D Tax Credits for Small Business Startups, Zero Emission Nuclear Power Production, Sustainable Aviation Fuel, Production of Clean Hydrogen, Advanced Manufacturing Production, Clean Electricity Production, Clean Electricity Investment, Clean Fuel Production, Renewable Electricity Production, Carbon Oxide Sequestration and so on. While the US government under President Biden has offered billions of dollars in tax credits for cleaner economy, a combination of carbon taxes, cap and trade systems, and carbon credits and offsets will greatly force traditional and legacy industries to curb emissions in industries that cannot switch to a cleaner model and will provide create a greater need to augment with carbon capture technologies and other methods.