On March 6, 2024, the US Securities and Exchange Commission (SEC) adopted new climate disclosure rules requiring public companies to disclose climate change-related information in their SEC filings. The rules aim to provide investors with consistent, comparable, and reliable information about the financial effects of climate-related risks on a company’s operations and how it manages those risks. In addition, they increase transparency, facilitate better decision-making, provide accountability, and encourage companies to adopt more sustainable business models. The SEC voluntarily stayed its implementation on April 4, 2024 pending completion of judicial review of consolidated challenges to the rules by the Court of Appeals for the Eighth Circuit. The SEC noted in its stay order that it intends to vigorously defend the validity of the climate rules.

Key Legal Challenges

The climate disclosure rules have faced significant legal challenges since their announcement. These challenges primarily stem from concerns regarding the SEC’s authority to regulate climate-related disclosures, the potential economic burden on companies, and the subjectivity of certain disclosure requirements.

Fifteen consolidated briefs were filed against the rules from business groups, Republican state attorneys, and energy companies. They argue the rules exceed statutory authority, impose substantial costs, lack clear standards, and violate the First Amendment by compelling companies to make certain statements about climate-related matters.

Large state pension funds (California and New York), institutional investors, Democratic state attorneys general, environmental activists, and even some business groups, filed 16 briefs in favor of the rules. Support from more than 15 institutional investors, representing over $2 trillion in assets, should carry substantial weight given the SEC’s claim that the rule was created as a result of investor demand. A study by The University of Texas at Austin found 439 institutional investors who were surveyed believe climate risk disclosures are crucial to evaluating a company’s financial well-being. In addition, more than 15 institutional investors (representing over $2 trillion) support the SEC’s rule, which was created due to investor demand. The institutional investors brief filed with the environmental nonprofit CERES says, “This is exactly what Congress established the SEC to do: ensure that investors have the information they need to make informed investment and voting decisions.”

They argue that the rules provide:

- Investor protection: Investors will be able to make informed decisions by providing them with essential information about a company’s financial condition, risks, and governance practices.

- Market efficiency: Transparent markets attract more investors and facilitate efficient allocation of capital.

- Corporate accountability: Companies are accountable for their actions and fraudulent or unethical behavior is deterred.

- Greater transparency: By requiring companies to disclose relevant information, disclosure rules can help level the playing field between investors and companies.

Current Status

August 15 was the deadline for amicus briefs. Plaintiffs have until September 17 to respond to the SEC’s written brief and submit supporting amicus briefs before verbal proceedings start later in the year. The US Court of Appeals for the Eighth Circuit is considering the challenges, and the outcome of this litigation will significantly impact the future of these rules. The courts will ultimately decide whether the SEC acted within its authority, whether the rulemaking process was appropriate, and whether the disclosure requirements are consistent with the law.

The outcome of these legal challenges could have significant implications for the future of climate-related disclosure requirements in the United States. If the rule is upheld, it could set a precedent for increased regulatory oversight of climate-related risks and disclosures. Conversely, if the rule is struck down, it could hinder efforts to provide investors with information about the potential financial impacts of climate change.

Likely Outcomes

The legal challenges to the SEC’s climate disclosure rules are ongoing and complex, with three potential outcomes:

- Full upholding: The rules could stand if the courts find that the SEC acted within its authority and that the disclosure requirements are reasonable and necessary for investor protection. This scenario would likely lead to a significant increase in climate-related disclosures by public companies.

- Partial invalidation: The courts might find certain aspects of the rules invalid while upholding others. This outcome could result in a modified version of the rules that would still require companies to disclose climate-related information, but with potentially narrower scope or less stringent requirements.

- Complete invalidation: The courts could argue that the rules exceed the SEC’s authority or are otherwise unlawful. This could create a confusing regulatory environment for climate-related disclosures, potentially resulting in a patchwork of state-specific rules.

The outcome of these legal challenges will depend on the specific arguments presented in court, the evidence supporting those arguments, and the interpretation of relevant laws and regulations by the judges. It is important to note that the legal process can be lengthy and unpredictable, and the final outcome may not be known for several years.

How Companies Should Prepare

Regardless of the outcome, the SEC is likely to continue examining companies’ climate disclosures, even those made under older guidelines. Meanwhile, companies might face separate climate reporting rules from other jurisdictions such as the European Union (EU) or California. Even if the SEC’s rules are rejected, investors will probably still push for more climate information, especially from large companies. Whether the SEC’s climate rules will stand and how long companies will have to follow them is still to be determined.

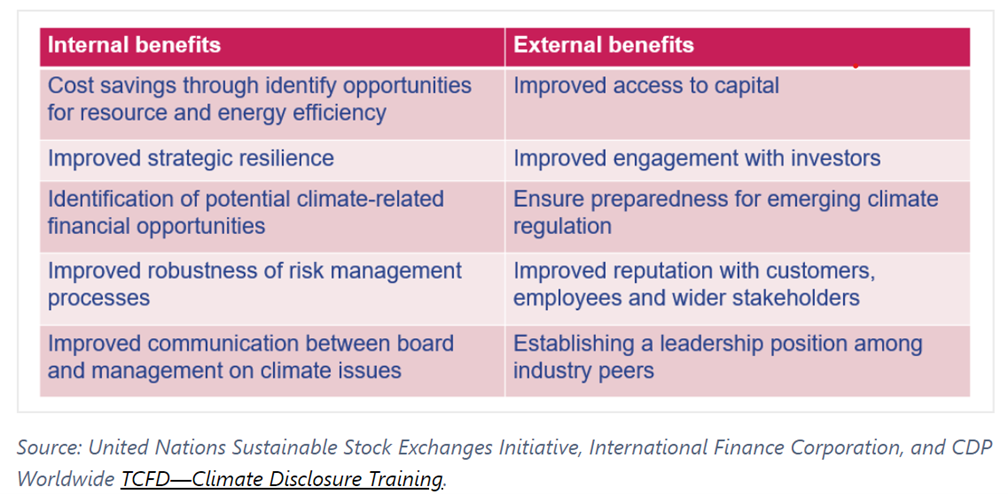

US companies should begin to prepare for the SEC climate disclosure rules now. Investors are increasingly prioritizing sustainability factors, and the rules will provide a standardized framework for companies to disclose climate-related information. Noncompliance can lead to financial penalties and reputational damage. By preparing early, companies can avoid last-minute scrambling and better position themselves for the future. Steps they can begin to take include:

- Assess current practices: Evaluate existing climate-related disclosures and identify any gaps.

- Gather data: Collect relevant data on GHG emissions, climate-related risks, and mitigation strategies.

- Identify material risks: Determine which climate-related risks are most significant to your business and its financial performance.

- Develop a disclosure strategy: Create a plan for how you will disclose climate-related information in your financial reports.

- Implement climate risk management: Develop and implement strategies to manage climate-related risks, such as reducing emissions and adapting to climate change.

- Engage with stakeholders: Communicate climate-related efforts to investors, customers, employees, and other stakeholders.

Companies should focus on key areas of disclosure that any existing or potential regulations will require such as climate-related risks, GHG emissions, climate-related governance, and climate-related financial impacts. Consider consulting with legal, accounting, and sustainability experts to navigate the complexities of not only the SEC’s climate disclosure rules, but also the EU’s Corporate Sustainability Reporting Directive (CSRD) and other sustainability regulations. In addition, continue to monitor regulatory developments and industry best practices to stay up to date on the latest guidance.