Carbon Border Adjustment Mechanism (CBAM) proposals in the United States are gaining bipartisan momentum, especially after the European Union passed its CBAM in October 2023, which will be gradually implemented over the next 10 years. A US CBAM would ensure that domestic production remains competitive as similar policies are rolled out in other countries across the globe. While the concept of a CBAM is largely unknown to most people, nearly 75% of voters nationwide support a CBAM once they understand what it is, even in states where the local economy relies on heavy manufacturing and fossil fuel industries.

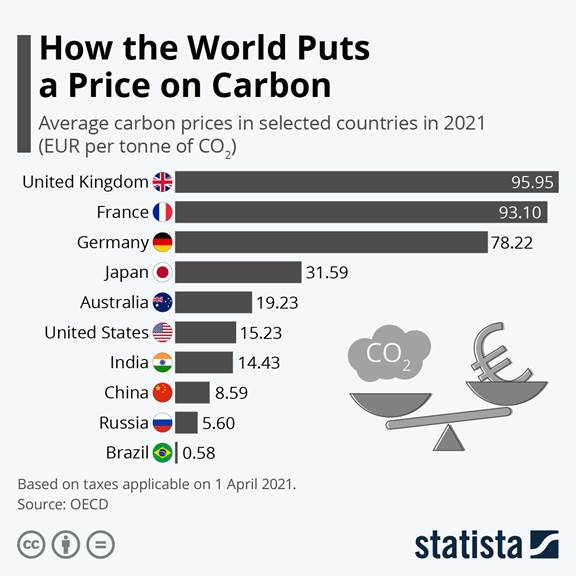

A CBAM is a trade policy tool designed to prevent carbon leakage, which occurs when companies relocate production from countries with strong climate policies and higher production costs due to carbon pricing to countries with weaker environmental regulations. This dynamic can lead to a shift in emissions rather than a true reduction. A CBAM imposes a fee on imported goods based on the carbon emissions embedded in their production in the exporting country, aiming to level the playing field by ensuring that imported goods face a cost similar to domestically produced goods, which are already subject to domestic carbon pricing. CBAM also incentivizes other countries to adopt their own carbon pricing mechanisms to avoid facing import fees.

Implementing a US Carbon Border Adjustment Mechanism

A US CBAM could be a significant step toward addressing climate change and promoting fair competition, however, its design and implementation must carefully consider the potential challenges and impacts on various stakeholders. It could draw from existing proposals and the EU’s CBAM, and function as a tariff or fee imposed on imported goods based on the carbon emissions associated with their production. Core components might include:

- Targeted sectors: Initially, the CBAM would likely focus on carbon-intensive sectors like steel, aluminum, cement, chemicals, and possibly fossil fuels, as in the EU.

- Emissions measurement: Importers would need to report the embedded emissions in their products, potentially using standardized methodologies and possibly third-party verification.

- Carbon price linkage: The CBAM fee would be linked to a carbon price, either explicitly (like a carbon tax or cap-and-trade system) or implicitly (based on regulations and other policies).

- Border adjustment: The fee would be applied at the border, effectively leveling the playing field between domestic producers (who may face carbon pricing) and foreign producers.

- Exemptions and rebates: There might be exemptions for goods from countries with comparable carbon pricing policies or for less-developed countries. Rebates could be provided for exported goods to maintain competitiveness.

Several design variations are possible for a US CBAM, including choosing an explicit approach that links the CBAM to an existing or future domestic carbon price, or using a more implicit approach based on regulatory costs. The scope of covered emissions could initially include direct emissions (Scope 1) and indirect emissions from energy use (Scope 2) with the potential for later expansion to include supply chain emissions (Scope 3). Similar to the EU’s approach, the US could implement the CBAM in phases, beginning with reporting requirements before gradually introducing fees. Finally, international cooperation could be key, with the US coordinating its CBAM with other countries to promote a more harmonized approach and mitigate potential trade tensions.

Carbon Border Adjustment Benefits for American Companies

By leveling the playing field, a CBAM would mitigate the competitive disadvantage US companies face due to “carbon leakage”, which occurs when companies relocate production to countries with less stringent environmental regulations to avoid higher production costs. By imposing fees on imports based on their embedded carbon emissions, a CBAM would increase the cost of imports from those countries, thereby protecting domestic industries and incentivizing investment in cleaner production methods.

A CBAM would encourage US companies to adopt cleaner technologies and more efficient production processes to maintain their competitive edge. This approach would stimulate innovation and investment in areas such as renewable energy, energy efficiency, and carbon capture technologies. Furthermore, a CBAM could signal to investors that the US is committed to addressing climate change, making it more attractive for investment in clean energy and sustainable technologies.

Imposing costs on imports from high-carbon-emitting countries could incentivize those nations to adopt their own carbon pricing mechanisms or strengthen their environmental regulations. A well-designed CBAM could also facilitate international cooperation on climate policy by encouraging collaboration on developing a global framework for carbon pricing.

Implementation Challenges and Considerations

A US CBAM could be a significant step toward addressing climate change and promoting fair competition. However, its design and implementation must carefully consider the potential challenges and impacts on various stakeholders. The specific design and implementation of a US CBAM will significantly influence the magnitude and nature of these challenges. Developing a CBAM will require new data forms to define the amount of greenhouse gases (GHGs) in individual products. Another challenge is determining a tariff and agreeing on a price, which could be difficult without comparable domestic data. In addition, a CBAM without a domestic component could be perceived as protectionist by US trading partners. Key factors in designing an effective CBAM include:

- Data collection and verification: Accurately measuring the embedded carbon emissions in imported goods across complex global supply chains is incredibly difficult, requiring detailed information from various producers and suppliers, which may be unavailable or unreliable.

- Trade and international relations: The design of a CBAM will need to comply with World Trade Organization (WTO) rules to avoid potential trade disputes and retaliatory measures from other countries.

- Developing countries: There are concerns on the potential impact on developing countries, which may face difficulties in meeting the requirements and could be disproportionately affected.

- Economic and administrative challenges: CBAMs could lead to increased costs for businesses, particularly importers, which may be passed on to consumers.

- Scope and coverage: Determining which products to include in a CBAM and how to address the issue of embodied emissions in complex manufactured goods is a complex task, particularly accounting for indirect emissions such as those from electricity generation or transportation in the production process.

While the US Congress has not yet made specific steps toward enacting a CBAM, four significant bills were introduced in 2023 that indicate growing interest in related legislation. The PROVE IT Act, Foreign Pollution Fee Act, MARKET CHOICE Act, and Clean Competition Act all pertain to global trade for carbon-intensive industries and could potentially be precursors to a CBAM-style framework in the US. The first three of these bills were bipartisan, which provides some basis for possible momentum, although the legislative winds have clearly shifted since President Trump’s election.

Conclusion

By addressing carbon leakage and incentivizing cleaner production both domestically and internationally, a CBAM can provide crucial support for American businesses while driving global decarbonization efforts. While implementation challenges, including data collection, international trade relations, and potential impacts on developing nations, must be carefully navigated, the potential benefits of a well-designed CBAM include bolstering domestic industries, stimulating innovation, and fostering international cooperation on climate policy.

A CBAM benefits American companies by making them more competitive in the global market, particularly in industries with relatively low carbon emissions, as they would be able to export goods at a lower price compared to competitors from countries with higher carbon footprints, essentially incentivizing them to further reduce their emissions and potentially capture a larger market share abroad; this is especially true for sectors like steel and aluminum where the US already has a carbon advantage compared to other producers.

If your company is considering how best to adapt to and comply with CBAM-related customer requirements, please contact Canopy Edge for an initial consultation to discuss the most effective strategies and best practices.