The Corporate Sustainability Reporting Directive (CSRD) and its accompanying European Sustainability Reporting Standards (ESRS) represent a significant shift in sustainability reporting, demanding greater transparency and comparability. The frameworks provide a new set of guidelines and standards that aim to align sustainability reporting for companies operating within the European Union. The first set of standards was released in July 2023 by the European Commission (EC), with sector-specific standards to be developed for later adoption. In January 2024, these standards became effective for companies within the scope of CSRD with reporting in 2025. The standards set a framework for organizations to consistently report data on environmental, social and governance (ESG) metrics.

The CSRD is a significant piece of EU legislation that replaces the previous Non-Financial Reporting Directive (NFRD) and mandates more extensive sustainability reporting for a broader range of companies, including large and publicly listed entities within the EU. The CSRD aims to standardize and enhance the quality of sustainability information, enabling investors and other stakeholders to make informed decisions. Key objectives include:

- Improving sustainability performance by increasing transparency and accountability.

- Enhancing investor decision-making by providing crucial sustainability information.

- Strengthening the EU’s capital markets by fostering a more sustainable and resilient financial system.

- Supporting the EU’s green transition by contributing to the goals of achieving climate neutrality and a just transition to a sustainable economy.

European Sustainability Reporting Standards Matter to US Companies

The standards have significant implications for US companies, even those not directly subject to EU’s CSRD due to:

- Global trends: The ESRS reflects a growing global trend toward more comprehensive and standardized sustainability reporting. These standards can demonstrate a company’s commitment to sustainability and enhance its reputation.

- Investor pressure: Investors are increasingly incorporating ESG factors into their investment decisions.

- Supply chain impacts: Many US companies operate within global supply chains that intersect with the EU. If their European suppliers are required to comply with the ESRS, US companies may indirectly be impacted and need to adapt their own sustainability practices.

- Regulatory convergence: The ESRS could influence the development of sustainability reporting standards in other jurisdictions, including the US.

- Competitive advantage: Early adoption of robust sustainability reporting practices, even if voluntary, can provide a competitive advantage by demonstrating leadership in ESG and attracting customers and talent.

Double Materiality

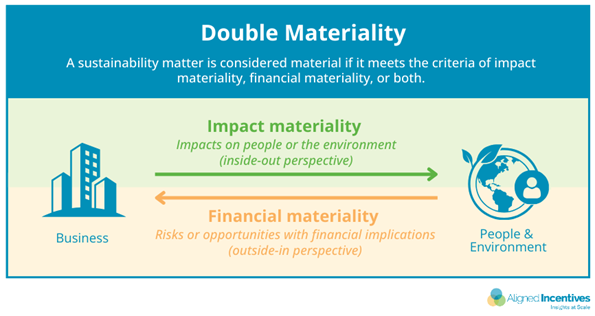

The ESRS introduced “double materiality” as the guiding principle for CSRD disclosures. This principle assesses the significance of sustainability matters to determine the information to disclose by unifying the two dimensions of materiality from earlier frameworks.

- Impact materiality: Focuses on how the company’s actions across the entire value chain impact people and the planet in the short, medium, and long terms.

- Financial materiality: Focuses on the company’s financial position, financial performance, cash flows, access to finance, or cost of capital over the short, medium, or long terms.

Assurance Requirements

Under the CSRD, companies are mandated to have their sustainability reports independently assured to guarantee their accuracy, reliability, and adherence to the ESRS standards. This assurance process commences with “limited assurance” and subsequently progresses to a higher level of “reasonable assurance.”

- Limited assurance involves an initial review of the company’s data collection methodologies, an evaluation of potential errors, and a general assessment of the reported information. Companies are obligated to obtain limited assurance from their initial reporting period and are then required to transition to reasonable assurance within a 2-year timeframe.

- Reasonable assurance demands a more comprehensive and rigorous level of scrutiny. Auditors are required to gather sufficient evidence to confidently confirm that the reported information is devoid of material errors and accurately reflects the company’s sustainability performance in accordance with the ESRS standards. This entails detailed examinations of metrics, disclosures, data sources, and the accuracy of the reported information.

Essential Dates for Compliance

- January 1, 2024: The ESRS officially entered into force.

- January 1, 2025: Large companies covered by the CSRD (those with over 500 employees and who are publicly listed in the EU) are required to report under the ESRS for financial years beginning on or after January 1, 2024.

- January 1, 2026: SMEs and other small and non-complex institutions must implement the CSRD and align with the ESRS for financial years beginning on or after January 1, 2026.

- June 30, 2026: The release of sector-specific ESRS reporting standards has been delayed to this date.

How to Prepare for Reporting Requirements

Companies need to begin by understanding the scope and applicability of CSRD, determining which entities within their organization fall under its scope and evaluating whether they meet the size and activity thresholds for mandatory reporting. It is important to conduct a double materiality assessment to identify environmental and social issues that significantly impact people and the environment, and those that pose significant financial risks or opportunities for the company. Engaging with stakeholders, such as employees, investors, customers, and suppliers, is essential throughout this assessment.

Companies must identify reliable data sources, establish effective data governance processes to ensure data quality and accuracy, and consider utilizing specialized software or tools to streamline data collection and reporting. Furthermore, companies need to integrate sustainability considerations into their overall business strategy and risk management processes. This involves setting ambitious targets aligned with relevant frameworks like the Paris Agreement, and developing and implementing action plans to achieve these goals.

Companies should ensure the board of directors has adequate oversight of sustainability matters, assign clear responsibilities for sustainability within the organization, and implement robust internal controls to maintain the accuracy and reliability of sustainability information. It is critical that companies are familiar with the assurance requirements of CSRD, and work closely with auditors throughout the process. Finally, continuous improvement is key. Companies must stay informed about any changes to CSRD and ESRS, continuously engage with stakeholders to understand their expectations and incorporate their feedback, and regularly review and refine their sustainability reporting processes to enhance accuracy, transparency, and comparability.

Conclusion and Recommendations

The CSRD and its accompanying ESRS mark a pivotal moment for sustainability reporting, demanding greater transparency, accountability, and comparability. While primarily focused on EU-based companies, ESRS has global implications. The growing emphasis on ESG factors by investors, the interconnectedness of global supply chains, and the potential for regulatory convergence in other jurisdictions necessitate that US companies pay close attention to these developments. Please contact Canopy Edge if you would like to discuss the most effective strategies for your organization to comply with CSRD, ESRS, or other key global sustainability frameworks.