The European Union’s Carbon Border Adjustment Mechanism (CBAM) is a new trade policy designed to prevent “carbon leakage.” This occurs when companies relocate their operations to countries with less stringent environmental regulations in order to avoid higher carbon costs. The EU implemented CBAM to ensure that goods imported into the EU are subject to a carbon price similar to that applied to domestically produced goods. Not only did CBAM address carbon leakage, but it will also contribute to the EU’s efforts to reduce greenhouse gas (GHG) emissions and achieve net zero emissions by 2050. The revenue generated can be used by the EU to support climate-related projects and investments.

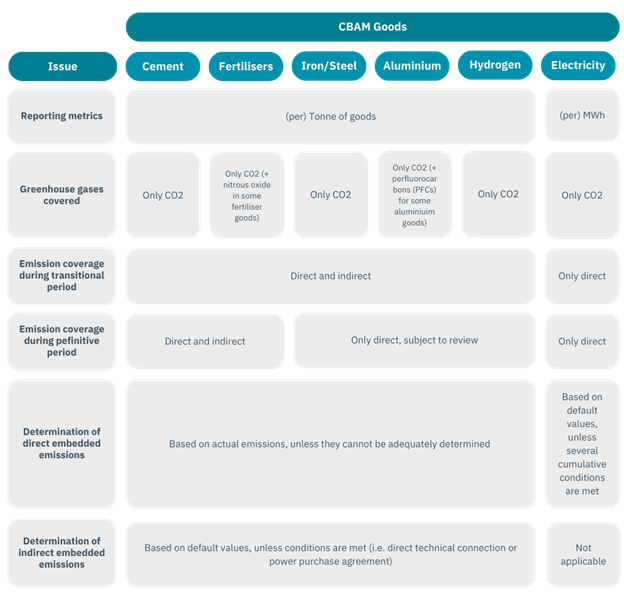

By imposing a carbon price on imports, CBAM aims to incentivize countries to reduce their emissions and level the playing field for EU businesses. CBAM currently applies to imports of certain cement, iron and steel, aluminum, fertilizers, electricity, and hydrogen products. This scope of industries and goods may be expanded in the future.

Transitional Phase (October 2023 – December 2025)

- Reporting: Importers must submit quarterly reports on the carbon emissions embedded in their imports. The first CBAM report was due January 1, 2024.

- No financial obligations: Importers do not need to purchase CBAM certificates or pay any fees during this phase.

Full Operational Period (Starting in January 2026)

- Financial obligations: Importers must purchase CBAM certificates corresponding to the embedded emissions in their imports and surrender them to the EU authorities.

- Phased introduction of financial obligations: The financial obligations will be phased in gradually over a period of nine years, with full cost accounting based on the carbon content of products starting in 2034.

It is important for US companies, especially those exporting goods to the EU, to understand reporting requirements in order to avoid substantial financial penalties, which can range from €10 to €50 per tonne of unreported emissions. Companies must comply with CBAM to avoid penalties and maintain market access to the EU. Complying with CBAM can help companies demonstrate their commitment to sustainability and transparency.

CBAM requires companies to report on the embedded emissions of their products. Companies will need to have a thorough understanding of their supply chains, including the emissions associated with each stage of production. This will provide them with an opportunity to identify areas where they can reduce emissions. They will also be better prepared for other regulation compliance such as the SEC Climate Disclosure rule and California SB 253 and SB 261, along with other future regulations.

Required Contents of CBAM Reports

Key Reporting Requirements

- Import Declarations: Importers must submit import declarations to customs authorities, including information on the product, its origin, and the carbon price applicable to it.

- Quarterly Reports: Importers must submit quarterly reports to the European Commission (EC), detailing their import activities and the carbon prices they have paid. These reports will be used to verify compliance and calculate any additional charges.

- Annual Reports: Importers may also be required to submit annual reports, providing more detailed information about their import activities and carbon footprint.

It is important to note that the specific data requirements for reporting may vary depending on the type of product, country of origin, and other factors. Importers should consult the relevant regulations and guidance to ensure compliance with CBAM reporting obligations.

What to Include in CBAM Reports

CBAM reports are crucial for importers of certain goods into the EU as they help to ensure that importers are contributing to the EU’s climate goals and preventing carbon leakage. Key elements to include in a CBAM report include:

- Quantity of imported goods: This information includes the total volume or weight of the imported goods that fall under the CBAM scope. To calculate the quantity of imported goods for CBAM, companies need to identify the covered goods, determine emission factors, calculate embedded emissions, and purchase carbon allowances. This process involves multiplying the quantity of imported goods by their emission factors to determine the embedded emissions and then purchasing the corresponding number of EU carbon allowances.

- Embedded emissions: The estimated GHG emissions associated with the production of these goods in the country of origin. This can be calculated using various methodologies, such as life cycle assessments (LCAs).

- CBAM certificates: The number of CBAM certificates purchased or surrendered to offset the embedded emissions. These certificates are issued by the EU and their price is linked to the EU Emissions Trading System (ETS).

- Supporting documentation: Evidence to support the reported quantity of goods and embedded emissions, such as invoices, shipping documents, and emission data from suppliers.

For the transitional period, importers may initially report estimated embedded emissions based on industry averages. Starting from 2026, importers will be required to report actual embedded emissions and purchase CBAM certificates to cover those emissions. Importers must ensure that their reports are accurate and complete, and maintain records of their import activities and carbon payments for a specified period. Importers may be subject to audits to verify the accuracy of their reports. Noncompliance can result in financial penalties, including fines and additional charges. In severe cases, noncompliance may lead to trade restrictions, such as import bans.

It is essential for companies to comply with the specific requirements and deadlines set by the EU for CBAM reporting. For more detailed information and guidance, companies should consult official EU resources or seek advice from experts familiar with CBAM regulations. It is important to note that the CBAM is a complex regulation with many moving parts. Importers should stay up to date on the latest developments and consult with experts to ensure compliance.