According to a recent PwC report, more than 250 companies have published sustainability reports under the European Union’s (EU’s) Corporate Sustainability Reporting Directive (CSRD) since the start of 2025. It is anticipated that more will follow as companies based and/or listed in the EU disclose information about their greenhouse gas (GHG) emissions, climate adaptation and mitigation efforts, employee working conditions, corporate governance, and more. Of the 100 reports PwC reviewed, nearly 90% of the companies are from five European countries, including Germany, Spain, and the Netherlands, which have not yet fully implemented CSRD into law. This means they are not under a legal obligation to report under CSRD but are likely doing so voluntarily due to mounting pressure from investors, regulators, and other stakeholders demanding greater transparency on sustainability performance.

The wide variations observed in the initial sustainability reports, both in length (30 to over 300 pages) and the number of disclosed sustainability-related impacts, risks, and opportunities (IROs) (fewer than 15 to more than 80), indicate that standardized best practices have yet to emerge. Consequently, stakeholders face challenges in making comparisons.

The CSRD, supported by 12 European Sustainability Reporting Standards (ESRS), requires companies to make detailed disclosures about sustainability performance and to consider the implications of sustainability for their business across a wide range of topics, including climate change, business conduct, resource use, pollution and biodiversity. About 50,000 companies globally will be affected.

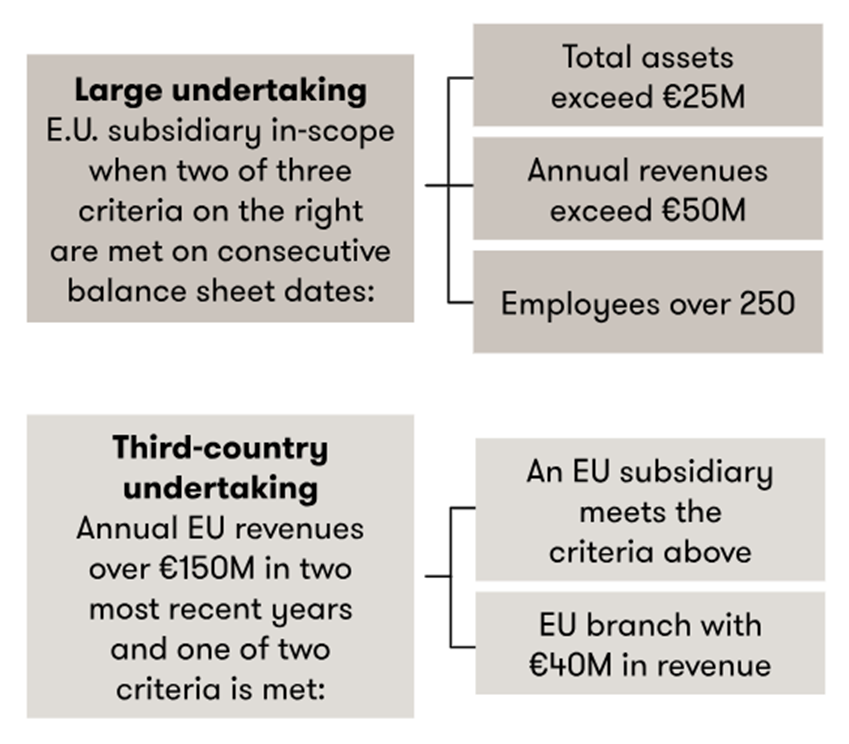

CSRD Scoping

Executives must determine which disclosure requirements, and which of more than 1,000 data points, are material and therefore need to be included in their reporting. In addition, they will need to provide qualitative reporting on their assessment for each IRO, along with their plans for addressing them. All this information requires independent assurance, beginning at the limited level and then moving to reasonable assurance. The CSRD envisions a potential shift to reasonable assurance by October 1, 2028, pending feasibility assessment and the development of EU-wide assurance standards. This move seeks to significantly enhance the credibility of sustainability reporting for stakeholders.

Double Materiality Assessment

Double materiality assessment is a central requirement of CSRD, which requires companies to evaluate and report on sustainability-related issues from both an impact and a financial perspective. As part of this process, companies identify sustainability-related IROs relevant for their reporting. These material IROs are then mapped to a standardized list of topics and sub-topics detailed in the reporting standards. Notably, the PwC report found considerable inconsistencies in how companies performed the double materiality assessment and the comprehensiveness of their process disclosures. While the majority of companies indicated they engaged with internal stakeholders, a significant number offered little detail about whether or how they engaged with external stakeholders. Moreover, many companies did not provide an explanation for why specific topics were excluded from their sustainability report as a result of their materiality assessment.

Most commonly reported topics include:

- Climate change, which includes mitigation, adaptation, and energy use

- Workforce conditions, including employee wellbeing and labor practices

- Business conduct, which includes ethics, and anti-corruption measures

Climate Change

A key finding from the PwC report is that climate change was considered a material topic by all but two companies. For the large majority that did identify it as material, around three-quarters disclosed a net zero target, and slightly more detailed their transition plan. However, the alignment of these targets with the Paris Agreement is not always clear. Regarding Scope 3 emissions (those occurring within the supply chain), companies, on average, reported on about half of the 15 categories specified in the reporting standard. Purchased goods and services and business travel are the most commonly disclosed categories, although this prevalence differs greatly depending on the industry.

Independent Assurance

Under CSRD, sustainability reports must undergo independent assurance, starting at a limited level. Demonstrating a commitment to greater transparency, some companies have opted for reasonable assurance—an enhanced level of verification—for specific key performance indicators (KPIs) or information such as GHG emissions or workforce data. Notably, one company sought reasonable assurance for its entire sustainability report.

Corporate Sustainability Reporting Directive (CSRD)

As of April 2025, the status of CSRD is dynamic, with recent developments significantly impacting its implementation timeline and scope. For example, The European Parliament and the Council of the EU have formally approved a 2-year delay for certain CSRD reporting requirements and the Corporate Sustainability Due Diligence Directive (CSDDD). This “stop-the-clock” proposal is part of an “Omnibus” package aimed at simplifying sustainability regulations.

- Large enterprises (the “second wave”), which were initially set to begin reporting in 2026 for the 2025 financial year, now have a reporting start date of 2028 (for FY 2027)

- Listed small and medium-sized enterprises (SMEs) (the “third wave”), initially scheduled for 2027 (for FY 2026), will now start reporting in 2029 (for FY 2028), with a potential opt-out until 2029

- Public interest entities already obligated to report in 2025 remain under this obligation

The European Commission (EC) is actively working on simplifying the ESRS with the aim of reducing the number of mandatory data points and clarify existing provisions. The European Financial Reporting Advisory Group (EFRAG) has been tasked with providing advice on a simplified set of ESRS by October 31, 2025. The Commission intends to adopt the amended delegated act on ESRS in time for companies to apply the revised standards for the 2027 financial year.

The Omnibus package also proposes a significant reduction in the number of companies subject to CSRD. Key proposals include:

- Increasing the employee threshold for EU companies to over 1,000 employees

- Raising the net turnover threshold for non-EU parent companies to €450 million generated in the EU

If these proposals are adopted, a substantial number of companies, particularly small and medium enterprises (SMEs), could be removed from the scope of CSRD. In addition, EU Member States are required to transpose the “stop-the-clock” directive into their national laws by December 31, 2025. It is important to note that some Member States have already transposed the initial CSRD requirements, and they will need to amend their laws to reflect the new timelines. Finally, the development of EU-wide assurance standards is ongoing. While limited assurance is the initial requirement, the CSRD envisions a move toward reasonable assurance by October 1, 2028, subject to a feasibility assessment by the EC. Member States may use national assurance standards until EU standards are adopted.

As of April 2025, the CSRD implementation is in a state of flux due to the recent approvals for delaying timelines and ongoing efforts to simplify reporting requirements and narrow the scope. Companies need to closely monitor the final transposition of the “stop-the-clock” directive at the national level and stay informed about the development of the revised ESRS.

Conclusion

Initial insights from PwC’s review of the first wave of sustainability reports under the EU’s CSRD reveal that the over 250 companies already reporting demonstrate a proactive approach to sustainability transparency. However, significant inconsistencies in the scope and depth of these reports highlight the ongoing absence of standardized best practices. The CSRD’s emphasis on double materiality and the detailed ESRS framework necessitates a comprehensive understanding of both impact and financial perspectives across a wide array of sustainability topics. Despite the recent approval of a 2-year delay for certain reporting requirements and efforts to simplify the ESRS and potentially narrow the scope of affected companies, the fundamental direction towards enhanced sustainability disclosure and independent assurance remains clear. As the regulatory landscape continues to evolve with national implementation and the development of EU-wide assurance standards, companies must remain vigilant in tracking these changes and preparing for a future where comprehensive and credible sustainability reporting is a fundamental aspect of corporate accountability. If your organization is looking for help in interpreting and navigating the rapidly evolving landscape for climate reporting and compliance, please contact Canopy Edge to schedule an initial consultation.