Despite talk of delays, California’s SB 253 and SB 261 appear to be on track for implementation in 2025. Companies will need to collect their Scope 1 and Scope 2 data beginning in 2025 to meet the 2026 reporting deadline. In 2027, Scope 3 data will need to be collected. Companies that have been proactively preparing for these regulations should continue to prepare for calculating and reporting their greenhouse gas (GHG) footprints, and assessing their climate-related risks using FY2025 data. For those who have not, delaying preparations could leave them scrambling to comply as the deadlines approach.

An analysis by the watchdog group Public Citizen estimates at least 75% of Fortune 1000 companies are covered by SB 253, while 73% are covered by both SB 253 and SB 261. The largest publicly traded US companies are included in the Fortune 1000, and will be subject to the Securities and Exchange Commission (SEC) rule which is currently paused but expected to be finalized in the next few months. California’s laws are more extensive in that they require companies to disclose Scope 3 emissions. This reporting includes purchased goods, business travel, and other indirect emissions in a company’s value chain. The emissions disclosure rules cover public and private firms with revenues exceeding $1 billion that do business in the state.

Climate Corporate Data Accountability Act (SB 253)

- Requires large public and privately held companies doing business in California to disclose their GHG emissions across their value chain, including Scope 1, 2, and 3 emissions.

- Mandates the disclosure of climate-related risks and opportunities, including those related to physical and transition risks.

- Applies to companies with total annual revenue exceeding $1 billion or with at least 500 employees.

Climate-Related Financial Risk Act (SB 261)

- Requires large publicly traded companies doing business in California to disclose the financial risks associated with climate change.

- Mandates the disclosure of climate-related risks that could materially impact the company’s financial performance.

- Applies to companies with total annual revenue exceeding $1 billion.

These laws are part of California’s broader efforts to address climate change and transition to a low-carbon economy. They represent a significant step forward in terms of transparency and accountability for companies operating in the state. They are among the toughest in the US, with significant implications.

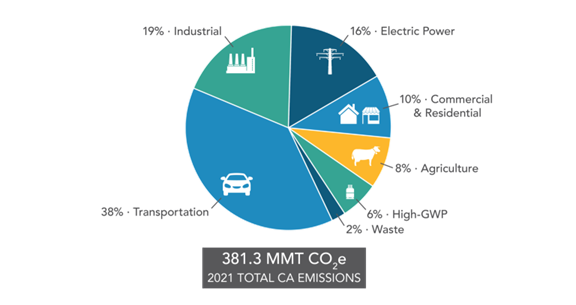

Breakdown of Total California Emissions

SB 253 and SB 261 Versus SEC Climate Disclosure Rules

Both sets of rules aim to increase transparency around climate-related risks and opportunities for companies, but they differ in several key aspects:

Scope: SEC rules apply to public companies registered with the SEC, regardless of their location. California laws are primarily focused on companies doing business in California, including private companies.

Requirements: SEC rules require disclosures on climate-related governance, strategy, risk management, and emissions. The rules also mandate the disclosure of Scope 1 and 2 emissions, and Scope 3 emissions if they are material or included in a company’s emissions reduction target. SB 253 requires disclosure of Scope 1, 2, and 3 emissions for companies with annual revenue over $1 billion, while SB 261 mandates climate-related financial risk reports for companies with annual revenue over $500,000. SB 253 and SB 261 focus on GHG emissions and climate-related financial risks.

Materiality: SEC rules use a materiality standard, meaning companies only need to disclose information that is relevant to investors’ decisions. SB 253 and SB 261 require mandatory disclosure of specified information, regardless of materiality.

Enforcement: SEC rules are enforced by the SEC, which can impose fines or other penalties for non-compliance. SB 253 and SB 261 are enforced by the California Air Resources Board (CARB), which may also impose penalties for noncompliance.

While the SEC rules and California’s laws are complementary, they differ in scope, requirements, and enforcement mechanisms. Companies operating in California may need to comply with both sets of regulations, while those operating outside of California may only need to comply with the SEC rules. Emissions under SB 253 must be reported in accordance with the GHG Protocol standards and guidance, a widely used set of guidance for accounting and reporting of GHG inventories. Noncompliance could lead to penalties of up to $500,000 per reporting year. However, companies will not be subject to penalties for misstatements of Scope 3 emissions that are made with a reasonable basis and in good faith. Penalties assessed for Scope 3 reporting between 2027 and 2030 shall only be for non-filing.

Preparing for SB 253 and SB 261

Companies should begin preparing now by taking the following steps:

- Assess current climate-related practices: Calculate Scope 1, 2, and 3 emissions. It is important to evaluate potential physical risks, such as extreme weather events, and transition risks like regulatory changes. In addition, companies need to review existing climate-related policies and practices to ensure they align with California’s requirements.

- Enhance data collection and reporting: Implement tools to track and analyze climate-related data. It is important to develop standardized procedures for collecting and reporting emissions data. Companies may even consider engaging independent auditors to verify the accuracy of emissions data.

- Develop a climate strategy: Companies should establish ambitious targets for reducing GHG emissions and mitigating climate risks. They should develop action plans to achieve climate goals, such as investing in renewable energy, improving energy efficiency, and adopting sustainable practices. In addition, they need to evaluate the potential financial impacts of climate change and develop strategies to manage risks.

- Engage with stakeholders: Companies need to disclose climate-related risks and opportunities to their investors. They should also work with partners to reduce emissions across the value chain.

- Seek expert guidance: Companies may consider consulting with climate experts to assess climate risks, develop mitigation strategies, and ensure compliance with regulations. In addition, they should closely monitor these developments and ensure compliance with the applicable disclosure requirements.

While the bills apply only to entities doing business in California, they reflect a global push for increased transparency in carbon accounting. The state’s laws are part of a growing trend of climate disclosure laws that include the European Union’s Corporate Sustainability Reporting Directive (CSRD) and pending regulations from the SEC. These developments are in response to investors’ demands to obtain consistent and reliable information that can help them integrate climate-related financial information into their investment decisions.

A growing number of companies have made commitments to achieving net zero emissions. For example, Coca-Cola HBC has pledged to reach net zero emissions by 2040 across its entire value chain through the adoption of renewable and low-carbon energy sources. They plan to reduce emissions from agricultural ingredients, implement circular economy features, and establish a “green fleet.”

Ford has pledged to go carbon neutral by 2050, and the company has committed to reaching net zero emissions from its vehicles and facilities worldwide. To achieve this goal, Ford will invest in electrification, renewable energy, and other sustainable technologies.

Enhanced transparency will enable investors to assess whether companies are greenwashing, or genuinely making progress toward these climate commitments.

To find out more about getting started on SB 253 and SB 261 compliance, contact Canopy Edge for an assessment of how we can quickly launch a highly effective and efficient program to make meaningful sustainability progress for your organization.