While Environmental, Social, and Governance (ESG) reporting is often associated with publicly traded companies, it is gaining significance for private companies as well. This movement is due, in part, to an increasing number of ESG regulations that include both public and private companies, such as the California Climate Corporate Accountability Act, Senate Bill (SB) 253. Illinois, New York, and the state of Washington are proposing similar acts, House Bill 4268, Assembly Bill A4123A, and SB-6092, that include public and private entities.

Although ESG has been popular with public companies for some time, ESG adoption has gained significant traction recently in private markets. Private equity (PE), venture capital (VC), and other private market participants are increasingly recognizing the value of integrating ESG principles into their investment strategies. They believe companies that prioritize ESG factors tend to achieve stronger financial performance over the long term. This is because it can lead to improved operational efficiency, reduced costs, and increased profitability. Companies that effectively manage their environmental impact may decrease expenses related to waste management and/or energy consumption.

Demonstrating a commitment to sustainability can make a private company more attractive to potential investors, increasing access to capital and potentially leading to a higher valuation. In addition, companies with robust ESG practices are often better prepared to weather economic downturns or regulatory changes. ESG reporting can help build stronger relationships with stakeholders, including employees, suppliers, and communities. While regulations may not currently mandate ESG reporting for all private companies, future regulatory changes could make it a requirement. Being proactive can help companies avoid penalties and ensure compliance.

Companies will be able to differentiate themselves in the marketplace and position themselves as leaders in sustainability through ESG reporting. A focus on ESG can drive innovation and lead to the development of new products or services that address environmental and social challenges.

Key Challenges in ESG Reporting

While ESG reporting has become increasingly prevalent among public companies, private companies face unique challenges in implementing and adhering to these standards. Key challenges can include:

- Investor pressure: As investor interest in ESG factors grows, private companies may face increasing pressure from stakeholders to disclose their ESG performance and progress.

- Resource constraints: Implementing ESG reporting can be expensive, especially for smaller private companies with limited resources.

- Expertise: Private companies may face a significant challenge in developing the necessary expertise and infrastructure to collect, analyze, and report ESG data.

- Data availability and quality: Ensuring consistent data collection and reporting across different departments and locations can be difficult. In addition, it can be time-consuming and resource-intensive to verify the accuracy and reliability of ESG data.

- Framework complexity: Navigating the complex landscape of ESG frameworks and standards, such as the Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB), can be overwhelming.

- Materiality: Determining which ESG issues are most material to a company’s business can be challenging, especially for those without a strong sustainability strategy.

- Regulatory changes: The ESG landscape is constantly evolving, with new regulations and reporting requirements being introduced. Keeping up with industry-specific ESG trends and best practices can be a challenge.

Despite these challenges, private companies are increasingly recognizing the importance of ESG reporting as a way to enhance their reputation, attract investors, and mitigate risks. By addressing these challenges and adopting effective ESG practices, private companies can position themselves for long-term success in a changing business environment.

Private Company Sustainability Case Studies

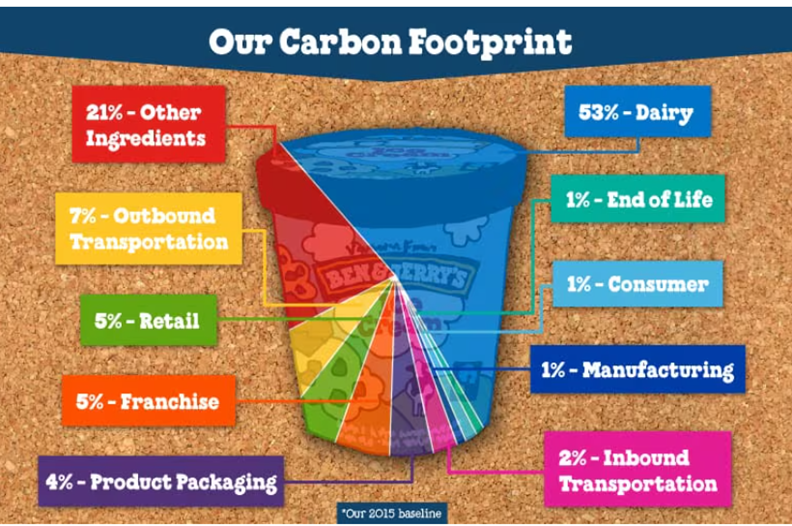

Ben & Jerry’s, a leading ice cream company, has a long history of activism and social responsibility, and its sustainability reports outline its efforts to reduce its environmental impact and support social justice causes. The company has set the following goals to reduce its carbon footprint:

- Company-owned facilities will use 100% renewable energy by 2025

- Reduce emissions intensity by 40% by 2025 (from our 2015 baseline)

- Reduce emissions intensity by 80% by 2050

Warby Parker, a global manufacturer and retailer of eyewear, has gained a reputation for its ethical business practices and has published sustainability reports detailing its efforts to reduce waste, run operations more efficiently, use resources responsibly, and limit greenhouse gas (GHG) footprint (while aiming to offset emissions so that its footprint is neutral across company operations).

Seventh Generation, a leader in natural and sustainable products, has been transparent about its sustainability practices through annual reports. The company was founded 30 years ago as a B Corporation, which means it is certified to meet rigorous standards of social and environmental performance, accountability and transparency. Seventh Generation developed Gen², which consists of four aspirational goals for 2020 to help measure everything the company does. The four goals are nurturing nature, enhancing health, building communities, and transforming commerce.

Conclusion and Recommendations

ESG reporting is becoming increasingly important for private companies, offering numerous benefits such as enhanced investor confidence, risk mitigation, improved reputation, regulatory compliance, and competitive advantage. By embracing ESG practices and reporting, companies can position themselves for long-term success in a rapidly changing business environment. They are able to enhance their reputation, mitigate risks, attract investors, improve operational efficiency, and comply with regulations.

In addition, a strong ESG reputation can position a private company as socially responsible and environmentally conscious, fostering trust with stakeholders. They are able to mitigate financial losses and reputational damage by identifying and addressing potential risks related to climate change, social issues, or governance failures. ESG reporting can also make a company more attractive to investors, potentially leading to lower financing costs.