A recent meta-study by the NYU Stern Center for Sustainable Business, in partnership with Rockefeller Asset Management, examined the relationship between environmental, social and corporate governance (ESG) activities at organizations and their financial performance in more than 1,000 research papers over the last 5 years. The authors surveyed 1,141 peer-reviewed papers and 27 meta-reviews (based on ~1,400 underlying studies) published between 2015 and 2020. The select papers are available through the Center’s new ROSI Research Database. Key findings of the research include:

- Improved financial performance due to ESG becomes more noticeable over the long term

- ESG investing provides protection during a social or economic crisis

- Sustainability initiatives at corporations appear to drive better financial performance due to mediating factors such as improved risk management and more innovation

- Managing a low-carbon future improves financial performance

- ESG disclosure without an accompanying strategy does not drive financial performance

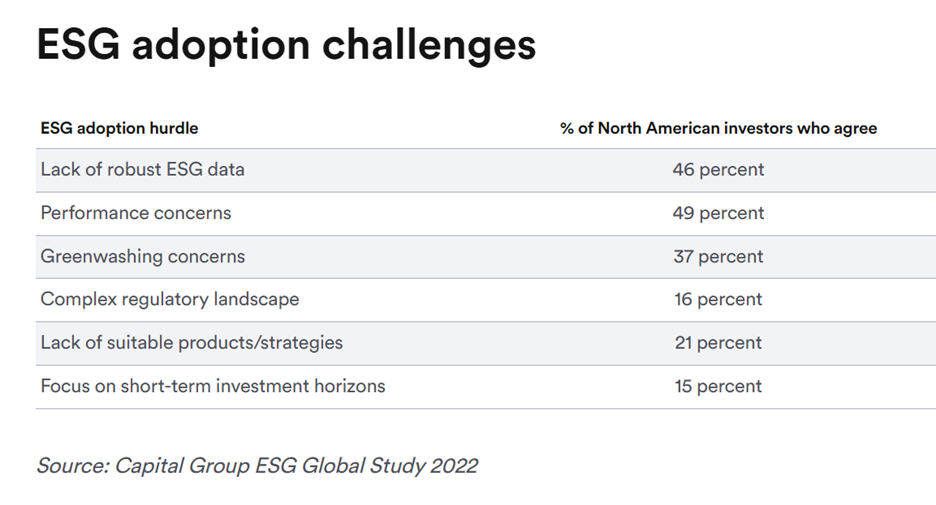

While investing in ESG can result in an improved financial performance, only about 45% of professionals surveyed in a recent Deloitte poll are confident in the ability of their organizations’ financial reporting teams to gather and report on ESG financial metrics to meet proposed and existing regulatory requirements. This points to the need for a dedicated role, an ESG controller, to ensure standards for data integrity are met. This is increasingly important as investors, consumers, and regulators are demanding greater transparency and accountability in a company’s ESG practices. The ESG controller plays a crucial role in ensuring a company meets these expectations.

Why Companies Need an ESG Controller

- Regulatory compliance: ESG controllers play a crucial role in ensuring regulatory compliance, with regard to staying up to date with changing ESG regulations, standards, and frameworks, such as the Securities and Exchange Commission’s (SEC) Climate Disclosures Rule, Sustainability Accounting Standards Board (SASB), and other regulations. In addition, the ESG controller helps to develop robust ESG reporting processes, ensure data integrity, and work with auditors and other assurance providers to validate ESG disclosures.

- Investor relations: ESG performance is becoming a significant factor in investment decisions. The ESG controller can help companies develop and communicate their ESG strategies effectively to attract investors.

- Risk management: As ESG factors can pose significant risks to a company’s reputation and financial performance, the ESG controller can help identify and mitigate these risks.

- Stakeholder engagement: The ESG controller can help companies engage with stakeholders, including employees, customers, and communities on ESG issues.

- Brand reputation: The ESG controller can help companies develop and implement ESG initiatives that align with their brand values. This can enhance a company’s brand reputation and attract customers.

- Sustainability: The ESG controller helps ensure that the company is operating in a sustainable manner, reducing its environmental impact and contributing to a more sustainable future.

In essence, an ESG controller is essential for companies that want to be sustainable, responsible, and successful in today’s competitive landscape. By ensuring that a company meets its ESG obligations, an ESG controller can contribute to its long-term financial health and reputation.

Integration of ESG-Related Risks into Governance, Risk, and Compliance Practices

The role of the ESG controller extends beyond overseeing ESG initiatives to integrating ESG-related risks into the organization’s broader Governance, Risk, and Compliance (GRC) framework. This integration involves several critical steps. The ESG controller must collaborate with risk management teams to identify and evaluate ESG-related risks that could affect the organization’s operations, reputation, or financial health. These may include potential greenwashing allegations, supply chain vulnerabilities, regulatory shifts, and human rights concerns.

Next, the ESG controller works to incorporate ESG risks into existing risk assessment processes, alongside traditional financial and operational risks. This provides decision-makers with a comprehensive risk landscape. They can then coordinate across departments to develop strategies addressing identified ESG risks. This may include implementing new policies and procedures, strengthening corporate governance structures, and developing stakeholder relationships.

Finally, the ESG controller oversees ongoing ESG risk monitoring and communicating key findings to senior leadership and the board. This process includes tracking risk metrics, identifying emerging trends, and strategic decision-making. By taking these steps, companies ensure that ESG considerations are fully integrated into the organization’s risk management and governance practices identification of ESG risks.

Key Qualities Necessary for an ESG Controller

An ESG controller plays a pivotal role in ensuring a company’s financial and sustainability practices are well aligned. Here are the essential qualities that are needed:

- Technical expertise: A strong understanding of financial accounting principles, GAAP, and IFRS. Also, a deep knowledge of ESG frameworks, standards (e.g., GRI, SASB, TCFD), and regulations. It is important to be proficient with data analysis tools and techniques in order to extract insights from ESG data. Finally, they need to be familiar with ESG data management software and other relevant technologies.

- Think strategically: It is important to be able to identify and assess ESG risks and opportunities. The ESG controller also needs to be creative in addressing ESG factors, and can integrate ESG considerations into long-term business strategies. In addition, they must be open to new ideas and technologies in the ESG space.

- Interpersonal skills: It will be critical to build relationships with stakeholders across departments, and work collaboratively with teams and external partners.

- Industry experience: While a strong foundation in accounting, finance, and ESG principles is essential, understanding the specific industry context can significantly enhance a controller’s effectiveness. Different industries face unique ESG challenges and opportunities. For example, a controller in the energy sector might need a deep understanding of carbon emissions regulations and renewable energy incentives, while one in the manufacturing sector might focus on supply chain sustainability and labor practices.

By seeking an ESG controller with these qualities, you can ensure that your company’s sustainability efforts are well-managed, transparent, and aligned with its overall business goals.

Conclusion and Recommendations

The NYU Stern Center for Sustainable Business’ meta-study provides compelling evidence that ESG practices are not only ethically sound, but also financially beneficial. However, the study also reveals a significant gap between the growing demand for ESG transparency and the capabilities of many organizations to meet these expectations. This is why it is important to look at adopting the role of an ESG controller to bridge this gap. By ensuring data integrity, regulatory compliance, and stakeholder engagement, an ESG controller can help organizations effectively navigate the evolving ESG landscape.

Based on the findings of the study and the increasing importance of ESG, companies should proactively integrate ESG considerations into their core business strategies, risk management frameworks, and innovation processes. This includes identifying and addressing ESG-related risks, developing sustainable practices, and measuring and reporting on ESG performance. Hiring an ESG controller to oversee ESG initiatives and ensure compliance with relevant regulations and standards is a critical component to help companies position themselves for long-term financial success, while contributing to a more sustainable and equitable future.