A growing number of states are implementing climate disclosure regulations due to investor demands, climate change mitigation, regulatory factors, and public pressure. Investors are increasingly requesting access to information about how climate change could impact a company’s financial performance in order to help them make more informed investment decisions. In addition, states hope to encourage companies to reduce their emissions and transition to a low-carbon economy by requiring companies to disclose their greenhouse gas (GHG) emissions and climate-related risks. There is also a growing public awareness of the impact of climate change with many stakeholders calling on companies to take action.

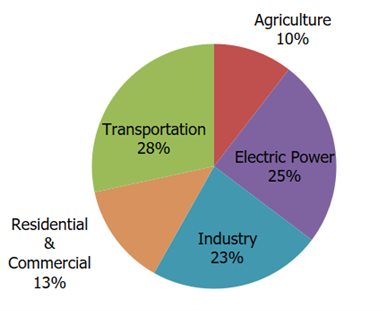

Total US Greenhouse Gas Emissions by Economic Sector: 2022

In March 2024, the Securities and Exchange Commission (SEC) adopted rules requiring public companies to disclose certain climate-related information in their SEC filings. The rules are designed to provide investors with consistent, comparable, and useful information for making investment decisions. They also provide consistent and clear reporting obligations for issuers. The new rules will require companies to disclose climate-related risks, climate-related goals, and targets including Scope 1, 2, and 3 emissions. They are expected to have a significant impact on public companies. They will need to collect and analyze a significant amount of new dataand develop new reporting processes. The rules will also have an impact on investors, as they will provide more information to assess the climate-related risks and opportunities of public companies. Currently, the new rules are subject to a temporary stay pending judicial review. However, even if the rules are ultimately overturned, they are likely to have a lasting impact on the way that public companies report on climate-related issues.

Despite the temporary stay, several states have implemented or are in the process of implementing climate disclosure regulations. California was the first state to enact comprehensive climate disclosure laws, including the Climate Corporate Data Accountability Act (SB 253) and the Climate-Related Financial Risk Act (SB 261). These laws require large companies doing business in California to disclose their GHG emissions and climate-related financial risks. Additional states are in the process of implementing climate disclosure regulations.

Illinois

The Illinois legislature passed comprehensive carbon capture, utilization, and sequestration (CCUS) legislation. CCUS involves the capture of carbon dioxide (CO2) directly from ambient air or use processes to separate carbon dioxide from industrial or energy-related sources, either for reuse or for underground injection for long-term storage. This establishes a comprehensive regulatory framework for the development of carbon capture and sequestration (CCS) projects.

The SAFE CCS Act establishes, among other requirements, protections for pore space owners, additional requirements for CO2 pipeline development, and a permitting program for sequestration projects. (“Pore space” is defined in the Act as the “portion of the geologic media … that can be used to store carbon dioxide.”) CCUS projects not grandfathered from the SAFE CCS ACT will now need to adhere to Illinois state sequestration requirements, in addition to existing federal regulations.

Minnesota

Minnesota recently enacted a climate disclosure regulation specifically targeting financial institutions. This regulation, part of the 2023 Commerce Omnibus Finance Bill, mandates that banks and credit unions with assets exceeding $1 billion must annually submit a climate risk disclosure survey to the Commissioner of Revenue. While the specific details of the required disclosures are yet to be finalized, the regulation aims to strengthen transparency regarding the potential financial risks posed by climate change.

It is important to note that the implementation of this regulation is still in its early stages, and further guidance and clarification on the specific disclosure requirements are expected from the Commissioner of Revenue. As the financial industry continues to navigate the evolving landscape of climate risk, staying updated on regulatory developments will be crucial for compliance and strategic planning.

New York

The New York State Senate is considering the proposed bill S5437, New York Climate Corporate Accountability Act, which will require all entities with over $1 billion in revenues earned from subsidiaries that do business in New York to report their emissions in the following year. The $1 billion threshold only includes revenue from subsidiaries that operate in New York, and not revenues from subsidiaries that do not operate in the state. Companies that meet the requirement will be obligated to report emissions information to an emissions registry. According to the proposed bill, the emissions registry is defined as “an entity within the department or a nonprofit emissions registry organization contracted by the department that either currently operates a voluntary GHG emissions registry for organizations operating in the United States; or has experience with voluntary GHG emissions disclosure by entities operating in New York.”

In the early stages of approval, the proposed bill includes definitions for Scope 1, 2, and 3 emissions. Understanding these definitions will be vital to ensure compliance with the mandatory requirements outlined in emissions reports to be submitted to the emissions registry. The proposed bill requires that companies adhere to the Greenhouse Gas Protocol Corporate Accounting and Reporting Standards and the Greenhouse Gas Protocol Corporate Value Chain Accounting and Reporting Standards when reporting Scope 3 emissions data.

Washington

Washington is considering legislation that would require large companies to disclose their climate-related risks and emissions. The Washington Climate Disclosure Bill, also known as Senate Bill 6092 or the Washington Climate Corporate Data Accountability Act, aims to require large businesses in Washington State to disclose their GHG emissions. Washington would be the second state in the US, after California, to mandate such comprehensive climate-related disclosures.

The bill would apply to businesses operating in Washington with annual global revenue exceeding $1 billion. Companies would be required to report their GHG emissions across Scope 1, 2 and 3 emissions. The timeline for reporting is not yet finalized, but it is expected to be similar to California’s regulations, which require reporting to begin in 2027. The bill aims to increase transparency about the climate impact of large businesses, empower consumers to make informed choices, and drive corporate action on climate change. It is important to note that this bill is still in the legislative process. If passed, it would likely be subject to further rulemaking and implementation by the Washington Department of Ecology.

The financial sector, along with policymakers, are increasingly recognizing the need for greater transparency and accountability in corporate climate disclosures. By requiring companies to disclose their GHG emissions and climate-related risks, states aim to empower investors to make informed decisions, incentivize companies to reduce their carbon footprints, and foster a more sustainable future.

Bottom line, the growing momentum behind climate disclosure regulations is driven by a number of factors, including heightened investor interest, regulatory pressure, and public awareness of climate change. States across the country are taking proactive steps to mandate climate-related disclosures, with California and a few other states leading the way. Investors and consumers are looking toward regulations to enhance transparency, enable informed decision-making, and drive corporate action towards a low-carbon economy. Companies need to recognize that the regulatory landscape will evolve meaning companies must adapt to these new requirements, collect and analyze relevant data, and develop robust reporting processes. If your company needs help interpreting and navigating the regulatory landscape, please contact Canopy Edge for a free advisory consultation.