2024 was the hottest year on record, with global temperatures surpassing 1.5°C above pre-industrial levels, leading to more intense hurricanes, wildfires, and floods. The global average temperature in 2024 was 15.1°C, which was 0.12°C higher than in 2023. Because of the increasing impact of climate change, the European Union and several US states are requiring sustainability reporting for public, and in some cases, private companies. The purpose of sustainability reporting is to provide stakeholders, such as investors, customers, employees, and communities, with a clear and comprehensive picture of a company’s sustainability performance. This information can help stakeholders make informed decisions about the company, such as whether to invest in it, buy its products, or work for it.

Materiality in Sustainability Reporting

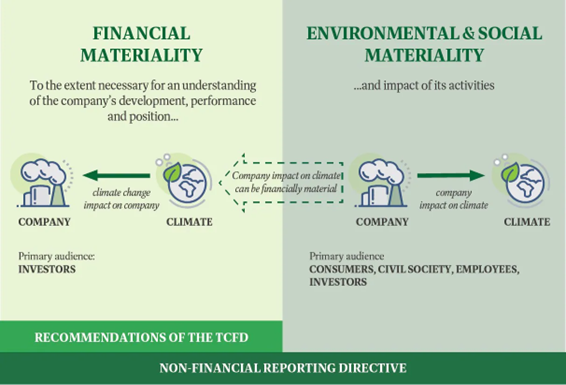

The concept of materiality is crucial in sustainability reporting because it helps companies focus their efforts on the issues that truly matter. By conducting a materiality assessment, companies can identify the environmental, social, and governance (ESG) factors most important to their stakeholders, such as investors, customers, employees, and communities, and prioritize them in their reporting. There are two types of materiality:

- Single materiality: Focuses on the financial impact of sustainability issues on the company’s performance. In this framework, companies assess how environmental and social issues could influence their financial health and investor decisions. This approach closely corresponds with traditional financial reporting, which emphasizes shareholder value.

- Double materiality: Recognizes and understands that a company’s impact on the environment and society is material to its financial performance. Double materiality acknowledges risks and opportunities from both financial and nonfinancial perspectives.

What Is Single Materiality in Sustainability Reporting?

Single materiality (traditional materiality), in the context of sustainability reporting, refers to identifying and reporting sustainability issues that are “material” to a company’s financial performance. Material sustainability issues can significantly impact a company’s financials in various ways, for example, climate change poses a threat to companies heavily reliant on fossil fuels or those operating in regions susceptible to extreme weather. These companies may face regulatory changes, carbon taxes, and physical damage to their assets, all of which can lead to substantial financial losses.

Single materiality, often used in traditional financial reporting frameworks and still common in sustainability reporting by some companies and reporting standards, provides a straightforward way to determine which sustainability issues to report on by prioritizing those most important for financial performance. However, it may overlook sustainability issues important to stakeholders but without a direct financial impact on the company.

What Is Double Materiality in Sustainability Reporting?

Double materiality offers a more comprehensive, transparent, and forward-looking approach to sustainability reporting. It considers both the impact of sustainability issues on a company’s financial performance and the impact of the company’s activities on the broader economy and society. This helps companies and stakeholders understand the broader implications of sustainability issues beyond the company’s immediate financial performance. While double materiality can be more complex to apply than single materiality, it may require more extensive data collection and analysis.

The concept of double materiality is gaining prominence in sustainability reporting, particularly with the introduction of the EU’s Corporate Sustainability Reporting Directive (CSRD). The CSRD mandates that companies conduct a double materiality assessment to identify and report on the sustainability issues most relevant to their business. While companies operating in the EU have been preparing for CSRD compliance for well over a year, the European Parliament is reportedly considering omnibus legislation that could potentially reduce the scope of CSRD applicability and reporting, as well as amend other EU sustainability laws. The US is not as far along as the EU with mandatory double materiality, but the concept is gaining traction and influencing climate disclosure regulations.

Conducting a Double Materiality Assessment

A double materiality assessment is crucial for any company aiming to create a comprehensive and meaningful sustainability report, as it ensures the report focuses on issues that truly matter to both the company and its stakeholders. Here are five key steps in conducting such an assessment:

- Define scope and context: To begin a double materiality assessment, it is essential to first define the scope of the company by identifying all relevant entities, including subsidiaries and the entire supply chain. This involves thoroughly mapping the organization’s upstream and downstream activities, encompassing suppliers, customers, and other stakeholders.

- Identify potential sustainability matters: Reviewing relevant frameworks and standards, like GRI, SASB, and ESRS, provides insight into potential topics. In order to understand stakeholder concerns and priorities, practitioners utilize methods such as surveys, interviews, and workshops. Finally, they analyze internal data, like existing sustainability reports and risk assessments, and external data, such as industry benchmarks, which offer a comprehensive view of relevant topics.

- Assess impact materiality: This involves evaluating both the actual and potential positive and negative impacts the organization has on people and the environment for each identified sustainability matter. This evaluation includes considering the scale, scope, and irreversible nature of those impacts, along with prioritizing the most significant impacts based on severity and likelihood.

- Assess financial materiality: For each sustainability matter, evaluate the potential financial risks and opportunities for the organization, and determine the probability of the financial impact occurring and its potential financial magnitude. It is important to focus on the most significant risks and opportunities based on their likelihood and magnitude.

- Determine materiality for disclosure: The findings from the impact and financial materiality assessments are integrated to pinpoint the sustainability topics that are material from both standpoints, and define the criteria for determining which topics warrant inclusion in sustainability reports. It is important to document the entire process, including the assessment methodology, stakeholder engagement activities, and the rationale behind all materiality determinations.

Companies Utilizing Double Materiality in Sustainability Reports

Many companies are beginning to utilize double materiality in their sustainability reports, especially with the rise of regulations like the EU’s CSRD.

Borregaard, a Norwegian company that operates one of the world’s most advanced and sustainable biorefineries, has conducted a double materiality assessment according to the ESRS and GRI Universal standards. They openly discuss their process and how it influences their sustainability reporting.

DSM and Firmenich: These companies conducted a new double materiality assessment for each division after a merger, highlighting the importance of adapting the process to specific circumstances.

It’s worth noting that while many companies are adopting double materiality, the level of transparency and detail in their reporting varies. Some sectors, like utilities and materials, tend to be more transparent due to stakeholder pressure and environmental impact.

If your organization is interested in conducting a materiality assessment or double materiality assessment to identify key priorities for your sustainability initiatives, please contact Canopy Edge for an initial consultation with our team of experts.