The European Union’s (EU) agricultural sector depends heavily on fertilizers to improve yields and ensure food self-sufficiency. As of 2022 alone, the EU-27 area imported around 7.5 million tonnes of fertilizers, predominantly from Egypt, Algeria, and the US. Unfortunately, this comes with significant emissions, particularly the production of ammonia, which is a key component in nitrogenous fertilizers accounting for roughly 1.8% of global carbon dioxide (CO2) emissions. The EU imports 30%, 68%, and 85% of its inorganic nitrogen, phosphates, and potash nutrients respectively, which means addressing emissions from imported fertilizer is crucial to accelerate the move to a decarbonized future.

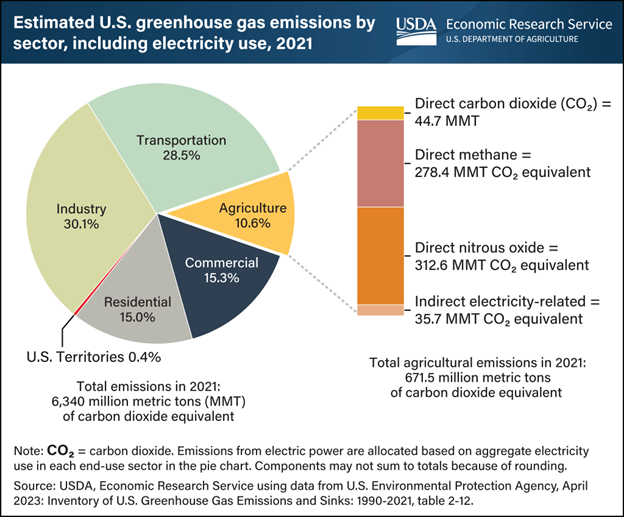

Greenhouse gas (GHG) emissions from agriculture have increased by 8% since 1990 due to the application of synthetic and organic fertilizers, deposition of livestock manure, and growing nitrogen fixing plants, which were the largest contributors to US nitrous oxide (N2O) emissions in 2022, accounting for 75% of total N2O emissions. The way in which manure from livestock is managed also contributes to methane (CH4) and N2O emissions as different manure treatment and storage methods affect how much of GHG are produced. Manure management accounts for about 14% of total GHG emissions from the agriculture sector in the United States.

The EU Commission has proposed amendments to some core sustainability reporting legislation as part of the EU Omnibus package, which was published on February 26, 2025. The proposed amendments have now entered the EU’s legislative process. Any company that imports or exports fertilizers to the EU will be affected by the Carbon Border Adjustment Mechanism (CBAM), including:

- Agriculture and food: CBAM will increase costs for the agriculture and food industry by pricing carbon in imported inputs, reshape supply chains by demanding carbon emissions data, drive sustainable practices by incentivizing low-carbon methods, and potentially raise food prices by passing on production costs.

- Chemicals: CBAM will increase costs for chemical imports with high emissions, which will force trade shifts and supply chain complexity, driving decarbonization by incentivizing cleaner production.

- Clothing and footwear: CBAM impacts clothing and footwear through increased costs in upstream sectors like chemicals and steel which impact material and machinery prices. It pushes a shift towards sustainable sourcing and production requiring supply chain transparency and potentially leading to higher consumer prices.

CBAM’s impact extends beyond individual companies, and it is ultimately expected to drive positive global sustainability outcomes in these sectors. By imposing a carbon tariff on imported fertilizers, CBAM could reward companies outside the EU that have already invested in decarbonization initiatives in their production processes. The regulation is expected to promote further industry innovation, including research and development of lower-carbon alternatives.

The Impact of CBAM on EU Importers

CBAM aligns import carbon costs with EU domestic production under the Emissions Trading System (ETS) framework, functioning as a carbon tariff. It forces importers to pay for embedded emissions with the aim of promoting low-carbon production. Importers, especially of fertilizers, face new costs via CBAM certificates, mirroring ETS prices, making the immediate impact financial. Long term, CBAM encourages low-carbon supply chains and innovation, but with potential upfront costs affecting sectors like agriculture that are already burdened by rising energy prices. While farmers face increased fertilizer expenses, they also stand to benefit from the resulting environmental improvements.

- Increased procurement costs: If a chemical company in Germany sources ammonia and methanol from a non-EU country with no carbon pricing mechanism, it will need to purchase CBAM certificates in 2026 corresponding to the embedded emissions associated with the products’ production. This is a direct financial cost from imported fertilizers, incurred by the importer requiring companies to assess the emissions of products in their supply chains to understand how to engage with suppliers for robust data collection, how to incentivize investing in cleaner production technologies or other decarbonization initiatives, or choose to search for alternative lower-carbon suppliers.

- Increased downstream costs: If a supplier imports its fertilizer outside of the EU, covering the cost of CBAM certificates and reporting will increase fertilizer prices, resulting in the cost trickling down to the farmer, and potentially, the end consumer. The impact of CBAM could therefore be felt across the supply chain.

- Supply chain disruptions: Under CBAM, importers are required to declare the quantity of imported fertilizers and their embedded emissions on a quarterly basis. Carbon data and transparency are therefore growing in importance.

Reporting Requirements

EU-based importers are responsible for reporting emissions associated with fertilizer imports. When submitting reports, the importer, or a nominated customs official, needs to:

- Declare the quantity of material imported.

- Declare emissions embedded in imports expressed in CO2 plus N2O for some fertilizer products.

- Starting in 2026, companies must report if goods are already carbon priced in the country of production or purchase, and if so, report the carbon price that is due or has been paid for the embedded emissions in the country of origin to avoid double charges.

Conclusion

The EU’s significant reliance on imported fertilizers, along with the substantial GHG emissions associated with their production and use, necessitate policy interventions like CBAM. While CBAM introduces immediate financial and operational requirements for importers across various sectors such as agriculture, chemicals, and clothing, it ultimately aims to promote global decarbonization by incentivizing cleaner production methods and fostering supply chain transparency, despite the potential for increased costs along the supply chain. If your company is looking for assistance in navigating CBAM reporting, please contact Canopy Edge for an initial consultation.